☐ |

|

|

|

GENPREX, INC. 3300 Bee CaveRoad, #650-227, Austin, TX 78746 |

|

|

|

|

|

|

Dell Medical Center, Health Discovery Building

1701 Trinity Street, Suite 3.322, Austin, TX 78712April 29, 2024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On October 1, 2018

Dear Stockholder:Our Stockholders:

You are cordially invited to attend the 2018 annual meeting2024 Annual Meeting of stockholdersStockholders (the “Annual Meeting”) of Genprex, Inc., (“Genprex” or the “Company”) to be held at 9:30 a.m. Central Time on Tuesday, June 18, 2024.

The Annual Meeting will be held in a Delaware corporationvirtual meeting format at www.proxydocs.com/GNPX. You will not be able to attend the Annual Meeting in person.

Details regarding the virtual meeting, the business to be conducted at the virtual meeting, and information about Genprex that you should consider when you vote your shares are described in the accompanying proxy statement.

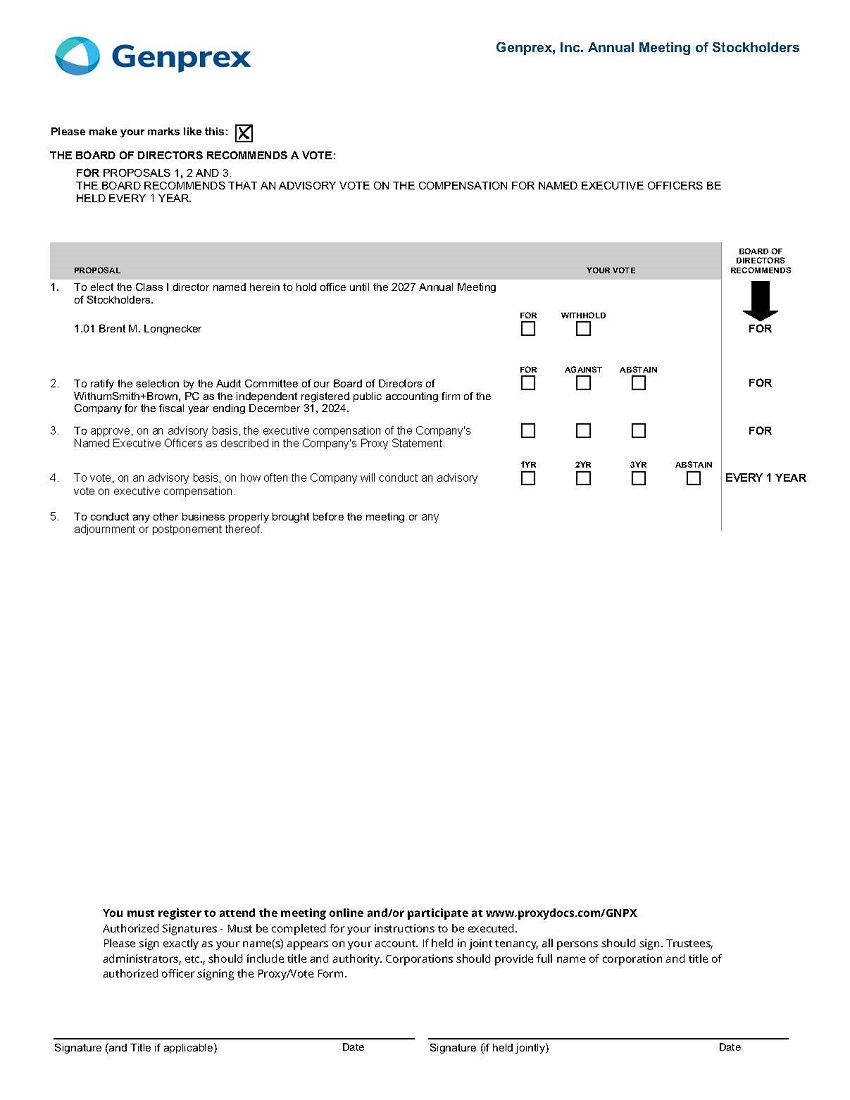

At the Annual Meeting, (i) one person will be nominated for election to our Board of Directors; (ii) we will ask stockholders to ratify the appointment of WithumSmith+Brown, PC as our independent registered public accounting firm for our fiscal year ending December 31, 2024; (iii) we will ask stockholders to approve, on an advisory basis, the executive compensation of the Company’s named executive officers as described in the proxy statement; and (iv) we will ask stockholders to vote, on an advisory basis, on how often we will conduct an advisory vote on executive compensation. We may also ask stockholders to consider and act upon other matters which may properly come before the meeting and/or any adjournment or adjournments thereof.

Under Securities and Exchange Commission (“SEC”) rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On or about May 6, 2024, we intend to begin sending to our stockholders a Notice of Internet Availability of Proxy Materials (the “Company”“Notice”) containing instructions on how to access our proxy statement for our 2024 Annual Meeting of stockholders and our 2023 Annual Report on Form 10-K (the “Annual Report”). The Notice also provides instructions on how to vote online and how to receive a copy of the proxy materials by mail or by email.

We hope you will be able to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, it is important that you cast your vote. You may vote over the Internet, by telephone, or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in the proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of Genprex. We look forward to seeing you during the webcast of the Annual Meeting.

Sincerely,  J. Rodney Varner Chief Executive Officer |

GENPREX, INC.

3300 Bee CaveRoad, #650-227, Austin, TX 78746

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on June 18, 2024

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Genprex, Inc. (“Genprex” or the “Company”) will be held on Monday, October 1, 2018Tuesday, June 18, 2024, at 10:9:30 a.m. (local time)Central Time. This year’s Annual Meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend our Annual Meeting virtually via the Internet and vote during the meeting by visiting www.proxydocs.com/GNPX. You will not be able to attend the Annual Meeting at the offices of W2O Group, 507 Calles Street, Suite 112, Austin, TX 78702, for the following purposes:a physical location.

THE ANNUAL MEETING WILL BE HELD FOR THE FOLLOWING PURPOSES:

1. |

|

| To elect the Class I director named herein to hold office until the |

| To ratify the selection by the Audit Committee of our Board of Directors of |

3. | To approve, on an advisory basis, the executive compensation of the Company’s named executive officers as described in this proxy statement. |

4. | To vote, on an advisory basis, on how often the Company will conduct an advisory vote on executive compensation. |

5. | To conduct any other business properly brought before the |

These items of business are more fully described in the Proxy Statementproxy statement accompanying this Notice.notice.

TheWHO MAY VOTE:

You may vote if you were the record date for the Annual Meeting is August 21, 2018. Only stockholdersowner of recordGenprex common stock at the close of business on April 25, 2024.

To participate in the Annual Meeting virtually via the Internet, please visit www.proxydocs.com/GNPX. In order to attend, you must register in advance at www.proxydocs.com/GNPX prior to the deadline of June 16, 2024, at 5:00 p.m. Eastern Time. Upon completing your registration, you will receive further instructions via email, including your unique links that date may vote atwill allow you access to the meeting or any adjournment thereof.and to submit questions in advance of the meeting. You will not be able to attend the Annual Meeting in person.

By Order of the Board of Directors,

/s/ Rodney Varner

Rodney Varner

Chief Executive Officer

Austin, Texas

August 29, 2018

YouAll stockholders are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the proxy mailed to you, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

Dell Medical School, Health Discovery Building

1701 Trinity Street, Suite 3.322, Austin, TX 78712

PROXY STATEMENT

FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On October 1, 2018

The Notice of Annual Meeting, this Proxy Statement and form of proxy are first being mailed on or about August 29, 2018 to all stockholders entitled to vote at the Annual Meeting.

|

THE INFORMATION PROVIDED IN THE “QUESTION AND ANSWER” FORMAT BELOW IS FOR YOUR CONVENIENCE ONLY. YOU SHOULD READ THIS ENTIRE PROXY STATEMENT CAREFULLY.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

How do I attend the Annual Meeting?

The meeting will be held on Monday, October 1, 2018 at 10:30 a.m. (local time) at the offices of W2O Group, 507 Calles Street, Suite 112, Austin, TX 78702. Information on how to vote in person at the Annual Meeting is discussed below.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on August 21, 2018 will be entitled to vote at the Annual Meeting. On this record date, there were 15,037,944 shares of common stock issued and outstanding and entitled to vote, held by 132 holders of record.

Stockholder of Record: Shares Registered in Your Name

If, on August 21, 2018, your shares were registered directly in your name with Genprex’s transfer agent, V Stock Transfer, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the proxy card that may be mailed to you, or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If, on August 21, 2018, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and this Proxy Statement and a voting instruction card are being forwarded to you by that organization. The

organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are three matters scheduled for a vote:

Proposal 1: To approve for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance by the Company of shares of common stock (“Shares”), warrants (“Warrants”) to purchase shares of common stock and shares of common stock to be issued upon exercise of the Warrants (“Warrant Shares”) pursuant to the terms of the private placement financing transaction (“ Private Placement”) contemplated by the Securities Purchase Agreement, dated May 6, 2018 (the “Securities Purchase Agreement”), between the Company and each of the investors named therein, and the other documents and agreements related thereto, without giving effect to the caps on issuing shares contained therein (the “Nasdaq 20% Issuance Proposal ”);

Proposal 2: To elect David E. Friedman as the Class I director to hold office until the 2021 annual meeting of stockholders; and

Proposal 3: Ratification of the selection by the Audit Committee of our Board of Directors of Daszkal Bolton LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018.

What if another matter is properly brought before the Annual Meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy card to vote on those matters in accordance with their best judgment.

How does the Board of Directors recommend I vote on the proposals?

The Board recommends a vote:

FOR the Nasdaq 20% Issuance Proposal;

FOR the election of David E. Friedman as the Class I director; and

FOR the ratification of the section by the Audit Committee of the Board of Directors of Daszkal Bolton LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018.

With respect to the Nasdaq 20% Issuance Proposal, you may either vote “For” or “Against” or abstain from voting. With respect to the election of Mr. Friedman as the Class I director on the Board of Directors, you may either vote “For” Mr. Friedman to the Board or you may “Withhold” your vote for him. With respect to the ratification of the selection of Daszkal Bolton as the Company’s independent registered public accounting firm, you may vote “For” or “Against” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy over the telephone, vote by proxy through the internet or vote by proxy using the proxy card enclosed with this Proxy Statement.important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by following the instructions in the Notice of Internet Availability of Proxy Materials that you previously received and to submit your proxy over the Internet or by mail in order to ensure your vote is counted.the presence of a quorum. You may stillchange or revoke your proxy at any time before it is voted at the meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 18, 2024

Our proxy materials including our proxy statement for the 2024 Annual Meeting, our Annual Report for the fiscal year ended December 31, 2023 and proxy card are available on the Internet at www.proxydocs.com/GNPX.Under SEC rules, we are providing access to our proxy materials by notifying you of the availability of our proxy materials on the Internet.

By Order of the Board of Directors,

J. Rodney Varner Chief Executive Officer |

Austin, Texas

April 29, 2024

TABLE OF CONTENTS

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | 2 |

PROPOSAL 1: ELECTION OF CLASS I DIRECTOR | 8 |

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | 10 |

INFORMATION REGARDING COMMITTEES OF THE BOARD OF DIRECTORS | 11 |

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS | 14 |

ETHICS CODE | 14 |

PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 15 |

EXECUTIVE OFFICERS | 17 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 18 |

EXECUTIVE OFFICER COMPENSATION | 19 |

PROPOSAL 3: ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | 26 |

PROPOSAL 4: ADVISORY VOTE ON FREQUENCY OF SAY-ON-PAY VOTES | 27 |

DIRECTOR COMPENSATION | 28 |

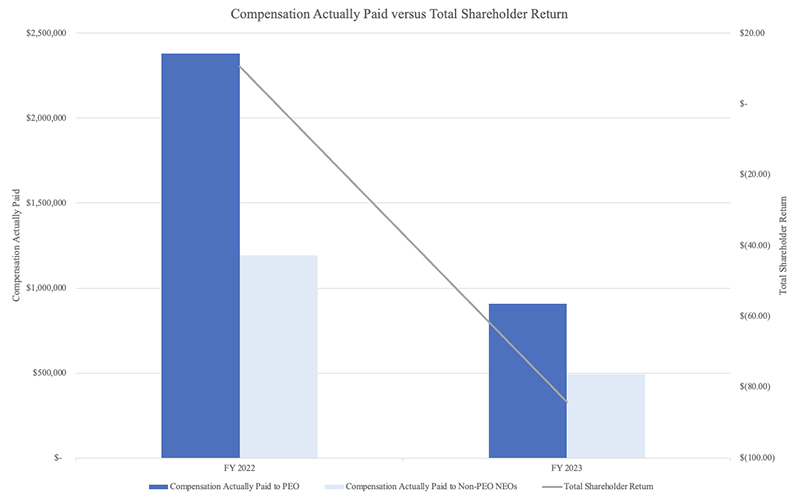

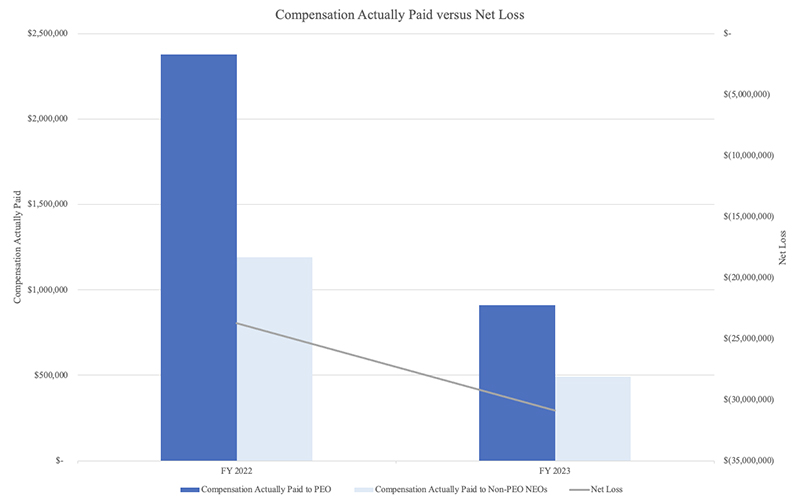

PAY VERSUS PERFORMANCE | 29 |

RELATED PARTY TRANSACTIONS | 32 |

STOCKHOLDER PROPOSALS | 33 |

ANNUAL REPORT | 33 |

HOUSEHOLDING OF ANNUAL MEETING MATERIALS | 33 |

OTHER MATTERS | 34 |

GENPREX, INC.

3300 Bee CaveRoad, #650-227, Austin, TX 78746

PROXY STATEMENT

FOR THE GENPREX, INC. 2024ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 18, 2024

This proxy statement contains information about the 2024 Annual Meeting of Stockholders of Genprex, Inc. (the “Annual Meeting”), including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting at 9:30 a.m., Central Time, on Tuesday, June 18, 2024. The Annual Meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend our Annual Meeting virtually via the Internet, vote and submit your questions in advance of the meeting by visiting www.proxydocs.com/GNPX. You will not be able to attend the Annual Meeting in person. In this proxy statement, we refer to Genprex, Inc. as “Genprex,” “the Company,” “we,” and vote in person even if you have already voted by proxy.“us.”

VOTE IN PERSON: You may comeThis proxy statement relates to the solicitation of proxies by our Board of Directors for use at the Annual Meeting. The proxy materials relating to the Annual Meeting are being mailed to stockholders entitled to vote at the meeting on or about May 6, 2024. A list of stockholders of record will be available during the 10 days prior to the Annual Meeting at the Company’s principal executive office located at 3300 Bee Cave Road, #650-227, Austin, TX 78746. If you wish to view this list, please contact our Corporate Secretary at Genprex, Inc., 3300 Bee Cave Road, #650-227, Austin, TX 78746. Such list will also be available for examination by the stockholders during the Annual Meeting at www.proxydocs.com/GNPX.

EXPLANATORY NOTE

Effective as of 12:01 am Eastern Time on February 2, 2024, we filed an amendment to our Amended and we will give youRestated Certificate of Incorporation to effect a ballot when you arrive.one-for-forty (1-for-40) reverse stock split of our issued and outstanding shares of common stock (the “Reverse Stock Split”). The information in this proxy statement reflects the Reverse Stock Split.

VOTE BY PHONE: To vote over the telephone, dial toll-free 866-356-9132 using any touch-tone telephone and follow the recorded instructions. You will be asked to provide the control number from the proxy card. Your telephone vote must be received by 11:59 p.m. Eastern Time on September 30, 2018 to be counted.

VOTE BY INTERNET: You may vote by completing an electronic proxy card at www.proxydocs.com/GNPX. You will be asked to provide the control number from the proxy card. Your internet vote must be received by 11:59 p.m. Eastern Time on September 30, 2018 to be counted.

VOTE BY PROXY CARD: To vote using a proxy card, simply complete, sign and date the proxy card enclosed with this Proxy Statement and return it promptly in the envelope we have provided or return it to Proxy Tabulator for Genprex, Inc., P.O. Box 8016, Cary, NC 27512-9903. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

Beneficial Owner: Shares Registered in the Name of Broker or BankIMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

If youWhy are a beneficial ownerwe calling this Annual Meeting?

Our Board of shares registered in the name ofDirectors is soliciting your brokerage firm, bank, dealer or other agent, you should have received voting instructions from that organization rather than from Genprex. Simply follow the voting instructions provided by the organizationproxy to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank. To vote in person at the Annual Meeting to be held virtually via live webcast on Tuesday, June 18, 2024, at 9:30 a.m. Central Time and any adjournments or postponements of the meeting. This proxy statement summarizes the purposes of the meeting and the information you need to know to vote at the Annual Meeting.

We have made available to you on the Internet or have sent you this proxy statement, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, because you owned shares of our common stock on the record date.

We are calling the Annual Meeting to seek the approval of our stockholders:

● | To elect Brent M. Longnecker to serve as a director for a three-year term expiring at the 2027 annual meeting of stockholders. |

● | To ratify the appointment of WithumSmith+Brown, PC as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

● | To approve, on an advisory basis, the executive compensation of the Company’s Named Executive Officers (defined below) as described in the proxy statement. |

● | To vote, on an advisory basis, on how often the Company will conduct an advisory vote on executive compensation. |

● | To consider any other matters that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

How Does the Board of Directors Recommend That I Vote on the Proposals?

Our Board of Directors believes that: (i) the election of the director nominee identified herein; (ii) the appointment of WithumSmith+Brown, PC as our independent registered public accounting firm for the year ending December 31, 2024; (iii) the compensation of our Named Executive Officers for the year ended December 31, 2023, as described in this proxy statement, was appropriate, and (iv) an annual vote, on an advisory basis, on conducting an advisory vote on executive compensation, are advisable and in the best interests of the Company and its stockholders and recommends that you vote as follows:

● | “FOR” the election of the nominee for director. |

● | “FOR” the ratification of the appointment of WithumSmith+Brown, PC as our independent registered public accounting firm for our fiscal year ending December 31, 2024. |

● | “FOR” the approval, on an advisory basis, of the executive compensation of the Company’s Named Executive Officers. |

● | For the Company holding an advisory vote on executive compensation “EVERY YEAR.” |

If any other matter is presented at the Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his or her best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

What Constitutes a Quorum for the Annual Meeting?

In order to hold the Annual Meeting, there must obtainbe a validquorum. At the Annual Meeting, the presence in person (including, in the case of the virtual Annual Meeting, by remote communication) or represented by proxy, of one-third (1/3) of the voting power of our stock outstanding on the record date and entitled to vote at the Annual Meeting will constitute a quorum for the Annual Meeting. Pursuant to the General Corporation Law of the State of Delaware, abstentions will be counted for the purpose of determining whether a quorum is present. If brokers have, and exercise, discretionary authority on at least one item on the agenda for the Annual Meeting, uninstructed shares for which broker non-votes occur will constitute voting power present for the discretionary matter and will therefore count towards the quorum.

Why is the Company Holding an Annual Meeting in virtual format?

This year’s Annual Meeting will be held in a virtual meeting format only. The virtual format provides the opportunity for participation by a broader group of our stockholders, while reducing costs associated with planning, holding and arranging logistics for in-person meeting proceedings. Hosting a virtual meeting also (i) enables increased stockholder attendance and participation because stockholders can participate equally from any location around the world, at little to no cost, and (ii) reduces the environmental impact of our Annual Meeting. You will be able to attend the Annual Meeting online and submit your brokerage firm, bank, dealer or other agent. Followquestions in advance of the meeting by visiting www.proxydocs.com/GNPX. You also will be able to vote your shares electronically at the Annual Meeting by following the instructions fromabove.

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the Securities and Exchange Commission (“SEC”), we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the Annual Meeting and help to conserve natural resources. If you received a Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your brokerproxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Who Is Entitled to Vote at the Annual Meeting?

Only stockholders who owned our common stock at the close of business on April 25, 2024, the record date for the Annual Meeting, are entitled to vote at the Annual Meeting. On this record date, there were 2,098,698 shares of our common stock outstanding and entitled to vote. Our common stock is our only outstanding class of voting stock.

You do not need to attend the Annual Meeting to vote your shares. Shares represented by valid proxies, received in accordance with the time periods specified in this proxy statement and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. For instructions on how to change or bank,revoke your proxy, see “May I Change or contact your broker or bank to request a proxy form.Revoke My Proxy?” below.

How many votes doMany Votes Do I have?Have?

On each matter to be voted upon, you have one vote for eachEach share of our common stock that you own as of the close of business on August 21, 2018.April 25, 2024, entitles you to one vote.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting.

What is the difference between holding shares as a stockholder of record and Ias a beneficial owner?

Many of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, VStock Transfer, LLC, you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to directly grant your voting proxy directly to us or to vote by remote communication at the Annual Meeting.

Beneficial Owner

If your shares of our common stock are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker, bank or nominee which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker as to how to vote and are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote these shares by remote communication at the Annual Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. If you do not vote, or if I return a proxy cardprovide the stockholder of record with voting instructions or otherwise obtain a signed proxy from the record holder giving you the right to vote without giving specific votingthe shares, broker non-votes may occur for the shares that you beneficially own. The effect of broker non-votes is more specifically described in “What Vote is Required to Approve Each Proposal and How are Votes Counted?” below.

How Do I Attend the Annual Meeting?

Both stockholders of record and stockholders who hold their shares in “street name” will need to register to be able to attend the Annual Meeting, vote their shares during the Annual Meeting, and submit their questions during the Annual Meeting live via the Internet by following the instructions what happens?below.

If you are a stockholder of record, and do not vote by completing your proxy card, by telephone, through the internet or in person at the Annual Meeting, your shares will not be voted.you must:

● | Follow the instructions provided on your Notice card to first register at www.proxydocs.com/GNPX by 5:00 p.m. Eastern Time on June 16, 2024. You will need to enter your name, phone number, control number (included on your proxy card), and email address as part of the registration, following which you will receive an email confirming your registration. |

● | On the day of the Annual Meeting, if you have properly registered, you will receive an email approximately one-hour prior to the Annual Meeting with a unique access URL. To enter the Annual Meeting, log in using the unique access URL. |

● | If you wish to vote your shares electronically at the Annual Meeting, you may do so by following the instructions below. |

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For”are the Nasdaq 20% Issuance Proposal, “For” the election of David E. Friedman as the Class I director and “For” the ratification of the selection by the Audit Committee of our Board of Directors of Daszkal Bolton LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street“street name”, you must:

● | Obtain a legal proxy from your broker, bank, or other nominee. |

● | Register at www.proxydocs.com/GNPX by 5:00 p.m. Eastern Time on June 16, 2024. As part of the registration process you will need to enter your name, phone number, and email address, and provide a copy of the legal proxy (which can be sent via email to the address listed on the registration website), following which you will receive an email confirming your registration and your control number. Please note, if you do not provide a copy of the legal proxy, you may still attend the Annual Meeting but you will be unable to vote your shares electronically at the Annual Meeting. |

● | On the day of the Annual Meeting, if you have properly registered, you will receive an email approximately one-hour prior to the Annual Meeting with a unique access URL. To enter the Annual Meeting, log in using the unique access URL. |

● | If you wish to vote your shares electronically at the Annual Meeting, you may do so by following the instructions below. |

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet. You may specify whether your shares should be voted for or withheld for each nominee for director and whether your shares should be voted for, against or abstain with respect to the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board of Directors’ recommendations. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name and I do not provide mythrough our stock transfer agent, Vstock Transfer, LLC, or you have stock certificates registered in your name, you may vote:

Voting During the Annual Meeting:

● | To vote during the live webcast of the Annual Meeting, you must first register at www.proxydocs.com/GNPX. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the Annual Meeting and to submit questions in advance of the meeting. Please be sure to follow the instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via email. |

Voting Prior to the Annual Meeting:

● | Over the Internet. You may submit your vote over the Internet at www.proxypush.com/GNPX. Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on June 17, 2024. Have your proxy card in hand as you will be prompted to enter your control number. |

● | By Mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the Board of Directors’ recommendations. Proxies submitted by mail must be received by the close of business on June 17, 2024 in order to ensure that your vote is counted. |

● | By Telephone. To vote over the telephone, dial toll-free 866-356-9132 using any touch-tone telephone and follow the recorded instructions. You will be asked to provide the control number from the proxy card. Your telephone vote must be received by 11:59 p.m. Eastern Time on June 17, 2024, to be counted. Have your proxy card in hand as you will be prompted to enter your control number. |

If your shares are held in “street name” (held in the name of a bank, broker, or bank with votingother holder of record), you will receive instructions what happens?from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted.

May I Change or Revoke My Proxy?

If you are a beneficial owner and do not instructgive us your brokerage firm, bank, dealerproxy, you may change or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is considered to be a “routine” matter under applicable rules. Brokers and nominees can use their discretion to vote uninstructed shares with respect to matters that are considered to be routine under applicable rules, but not with respect to non-routine matters. Under applicable rules and interpretations, non-routine matters are matters that may substantially affect the rights or privileges of stockholders, including the Nasdaq 20% Issuance Proposal and elections of directors (even if not contested). Accordingly, without your instructions your broker or nominee may not vote your shares on Proposal 1 or Proposal 2, but may vote your shares on Proposal 3.

If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Who is paying for this proxy solicitation?

The Company will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks, dealers or other agents for the cost of forwarding proxy materials to beneficial owners.

What if I Receive More Than One Proxy Card or Voting Instruction Form?

If you hold your shares in multiple accounts or registrations, or in both registered and street name, you will receive a proxy card or voting instructions form for each account. Please sign, date and return all proxy cards you receive from the Company. If you choose to vote by proxy via the telephone or the internet, please vote once for each proxy card you receive. Only your latest dated proxy for each account will be voted.

What if I have questions about my Genprex shares or need to change my mailing address?

You may contact our transfer agent, V Stock Transfer, LLC, by telephone at (855) 9VSTOCK or, or by email at info@vstocktransfer.com if you have questions about your Company shares or need to change your mailing address.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxyit at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, youYou may change or revoke your proxy in any one of the following ways:

● | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

You may submit another properly completed

● | by re-voting over the Internet as instructed above; |

● | by notifying our Corporate Secretary in writing before the Annual Meeting that you have revoked your proxy; or |

● | by attending the Annual Meeting and voting at the meeting. Attending the Annual Meeting will not in and of itself revoke a previously submitted proxy. |

Your most current vote, whether by Internet, telephone, or proxy card with a later date.

You may grant a subsequent proxy by telephone or through the internet.

You may send a timely written notice that you are revoking your proxy to Genprex’s Secretary at Genprex, Inc., Dell Medical School, Health Discovery Building, 1701 Trinity Street, Suite 3.322, Austin, TX 78712.

You may attend the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. Your most recent proxy card or telephone or internet proxy is the one that will be counted. For purposes of submitting your vote over the Internet before the Annual Meeting, you may change your vote until 11:59 p.m. Eastern Time on June 17, 2024. At this deadline, the last vote submitted will be the vote that is counted.

Beneficial Owner: Shares RegisteredWhat if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the Namemanner described above under "How Do I Vote?" for each account to ensure that all of Broker or Bank

If your shares are heldvoted.

What are “broker non-votes”?

Banks, brokers and other agents acting as nominees are permitted to use discretionary voting authority to vote for proposals that are deemed “routine” by your brokerage firm, bank, dealerthe New York Stock Exchange, which means that they can submit a proxy or cast a ballot on behalf of stockholders who do not provide a specific voting instruction. Brokers, banks or other agent as a nominee,nominees are not permitted to use discretionary voting authority to vote for proposals that are deemed “non-routine” by the New York Stock Exchange.The determination of which proposals are deemed “routine” versus “non-routine” may not be made by the New York Stock Exchange until after the date on which this proxy statement has been mailed to you. As such, it is important that you should follow theprovide voting instructions provided byto your bank, broker or bank.other nominee as to how to vote your shares, if you wish to ensure that your shares are present and voted at the Annual Meeting on all matters and if you wish to direct the voting of your shares on “routine” matters.

When are stockholder proposalsthere is at least one “routine” matter to be considered at a meeting, a “broker non-vote” occurs when a proposal is deemed “non-routine” and director nominations duea nominee holding shares for next year’s annual meeting?a beneficial owner does not have discretionary voting authority with respect to the “non-routine” matter being considered and has not received instructions from the beneficial owner.

ToThe election of directors (Proposal 1), the advisory vote on executive compensation (Proposal 3), and the advisory vote on how often the Company will conduct an advisory vote on executive compensation (Proposal 4) are generally considered to be “non-routine” matters and brokers, banks or other nominees are not permitted to vote on these matters if the broker, bank or other nominee has not received instructions from the beneficial owner. Accordingly, it is particularly important that beneficial owners instruct their brokers, banks or other nominees how they wish to vote their shares on these proposals. The proposal to approve the ratification of our independent registered public accounting firm (Proposal 2) is generally considered for inclusion into be a “routine” matter, hence, a broker, bank or other nominee will have discretionary authority to vote on Proposal 2 even if it does not receive instructions from the Company’s proxy materials for next year’s annual meeting, your proposal mustbeneficial owner. However, if Proposal 2 is deemed by the New York Stock Exchange to be submitted in writing by December 28, 2018.a “non-routine” matter, brokers will not be permitted to vote on Proposal 2 if the broker has not received instructions from the beneficial owner. Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares.

Will My Shares be Voted if I Do Not Vote?

If you wish to submit a proposal (including a director nomination) that isare the stockholder of record, your votes will not to be included incounted if you do not vote as described above under “How Do I Vote?” above. If you are the Company’s proxy materials for next year’s annual meeting, you must do so not later than the close of business 90 days, nor earlier than the close of business 120 days, prior to the first anniversary of the date of the 2018 Annual Meeting. In the event the date of the 2019 annual meeting is more than 30 days before or more than 30 days after such anniversary date, notice must be delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. You are also advised to review the Company’s amended and restated bylaws, which contain additional requirements relating to advance notice of stockholder proposals and director nominations.

Proposals should be addressed to:

Genprex, Inc.

Attn: Corporate Secretary

Dell Medical School, Health Discovery Building

1701 Trinity Street, Suite 3.322

Austin, TX 78712

What are “broker non-votes”?

When a beneficial owner of shares held in “street name” doesstreet name and you do not giveprovide voting instructions to the brokerage firm, bank, dealerbroker or other agent holdingnominee that holds your shares, the bank, broker or other nominee that holds your shares as to howhas the authority to vote your unvoted shares only on matters deemedthat are considered to be non-routine under applicable rules,“routine” by the New York Stock Exchange. The ratification of the appointment of our independent registered public accounting firm (Proposal 2) is generally considered to be a “routine” matter by the New York Stock Exchange but the election of directors (Proposal 1), the advisory vote on executive compensation (Proposal 3), and the advisory vote on how often the Company will conduct an advisory vote on executive compensation (Proposal 4) are generally considered “non-routine” matters. If you are the beneficial owner of shares held in street name, we encourage you to provide voting instructions to your bank, broker or nominee cannot vote the shares. These unvotedother nominee. This ensures your shares are counted as “broker non-votes.”

How are votes counted and how many votes are needed to approve each proposal?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will tabulate the votesvoted at the Annual Meeting and in the manner you desire.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

Proposal 1: Election of Director

Our directors are elected by a plurality, which means that the nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will separately count:

With respectbe elected up to the Nasdaq 20% Issuancenumber of directors being elected at this meeting. This means that the one nominee who receives the largest number of affirmative votes cast on the election of directors will be elected. You may vote either FOR the nominee or WITHHOLD your vote from the nominee. Votes that are withheld will not be included in the vote tally for the election of the director. This Proposal votes “For” and “Against,”1 is generally considered to be a “non-routine” matter which means that banks, brokers or other nominees do not have discretionary authority to vote on this matter. As a result, abstentions and broker non-votes;“broker non-votes” if any, will not affect the outcome of the vote on the first proposal. Holders of common stock are not entitled to cumulative voting in the election of directors.

With respect to the proposal to elect David E. Friedman as the Class I director, votes “For,” “Withhold” and broker non-votes; and

With respect to the proposal to ratify the Audit Committee’s selectionProposal 2: Ratify Appointment of Daszkal Bolton LLP as our independent public accounting firm, votes “For” and “Against,” abstentions and broker non-votes.Independent Registered Public Accounting Firm

The affirmative vote of the holders of a majority of the shares of our common stock present or represented by proxy and entitled to vote on the matterthis Proposal 2 is required to approve the Nasdaq 20% Issuance Proposal. In addition, for Nasdaq purposes, the Nasdaq 20% Issuancethis Proposal requires approval by2. This Proposal 2 is generally considered to be a majority of the votes cast at the meeting, provided“routine” matter which means that the investors in the Private Placement shall not be entitledbanks, brokers or other nominees will have discretionary authority to vote eitheron this matter. Accordingly, we do not expect that any broker non-votes will occur on this Proposal 2; however, if any broker non-votes were to occur on this Proposal 2 such broker non-votes would have the Shares owned by them or the Warrant Shares underlying Warrants owned by them, which are the Shares and Warrants to purchase our common stock that were issued to the investors pursuant to the Securities Purchase Agreement. If you mark your proxy as “Abstain” on the Nasdaq 20% Issuanceeffect of votes against this Proposal or2. Abstentions, if you give specific instructions that no vote be cast on any, specific matter, the shares represented by that proxy will not be voted on that matter, but will count in determining whether a quorum is present. Broker non-votes have no effect toward the vote total for the Nasdaq 20% Issuance Proposal. Abstentions will have the effect of an “Against” vote on the Nasdaq 20% Issuancevotes against this Proposal because abstentions2. We are considered shares entitlednot required to vote on this proposal. With respect to the Nasdaq 20% Issuance Proposal, if a stockholder is a beneficial owner of shares held in street name, such stockholder’s bank, broker or other nominee will not be permitted to vote such stockholder’s shares onobtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the Nasdaq 20% Issuance Proposal unless the bank or broker receives voting instructions from such stockholder.

For the electionappointment of directors, the nominees receiving the most “For” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. The only nominee for Class I director to be considered at the Annual Meeting is Mr. Friedman. Only votes “For” will affect the outcome of Proposal 2.

To be approved, the ratification of the selection of Daszkal Bolton LLPWithumSmith+Brown, PC as the Company’sour independent registered public accounting firm for 2024, the Audit Committee of our Board of Directors will reconsider its fiscal year ending December 31, 2018, must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes, if any, will have no effect.appointment.

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.Proposal 3: Advisory Vote on Executive Compensation (Say-on-Pay)

What is the quorum requirement?

A quorum of stockholders is necessary to hold the Annual Meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the Annual Meeting in person or represented by proxy.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your brokerage firm, bank, dealer or other agent) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the Annual Meeting in person or represented by proxy may adjourn the Annual Meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

PROPOSAL 1

NASDAQ 20% ISSUANCE PROPOSAL

Private Placement

On May 9, 2018, we issued an aggregate of 828,500 shares of our common stock (the “Shares”) at a purchase price of $12.07 per share (the “Per Share Purchase Price”) and warrants to purchase up to 621,376 shares of our common stock (the “Warrants”) with an initial exercise price equal to $15.62 per share (the “Exercise Price”), in a private placement (the “Private Placement”) in accordance with a securities purchase agreement (the “Securities Purchase Agreement”) entered into with certain institutional and accredited investors (collectively, the “Purchasers”) on May 6, 2018. The Per Share Purchase Price and the Exercise Price were subject to adjustment as described below. The total consideration paid to us in the Private Placement was approximately $10,000,000. When issued, the Warrants were exercisable on the earlier of six months from the issuance date or the date of effectiveness of the registration statement registering the underlying shares for resale, in each case subject to ownership limitations, and expire five years from such date. The Warrants are exercisable on a cashless basis six months after the issuance date if there is then no effective registration statement registering the resale of the shares underlying the Warrants. The $10,000,000 purchase price paid by the Purchasers on May 9, 2018 represents the entire purchase price that will be paid by the Purchasers for the Shares and the Warrants, even if additional Shares are issued and additional Warrant Shares become issuable following a Triggering Event discussed below. If the Warrants are exercised in full on a cash basis, we will receive an additional $9,705,893.

We engaged Maxim Group, LLC (“Maxim”) as our exclusive placement agent in connection with the Private Placement. Network 1 Financial Securities, Inc. served as an advisor in connection with the transaction.

When the Shares and Warrants were issued, the Per Share Purchase Price of the Shares, the Exercise Price of the Warrants and the number of Warrant Shares were subject to adjustment based on the lowest volume weighted average price (“VWAP”) for the three trading days (the “VWAP Calculation”) immediately following each of the following events (“Triggering Events”): (i) the date that a registration statement covering the resale of the Shares issued in the Private Placement has been declared effective by the SEC, (ii) if a registration statement covering all Shares issued in the Private Placement is not declared effective, then the date that the Shares can be sold under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), and (iii) if later than the dates set forth in (i) and (ii), then the date that our stockholders approve the Nasdaq 20% Issuance Proposal. Following a Triggering Event, the Per Share Purchase Price for the Shares would automatically be reduced, if applicable, to 85% of the

lowest of the three VWAPs in the VWAP Calculation, and we would be required to issue to the Purchasers additional Shares to reflect the adjustment to the Per Share Purchase Price so that the total number of Shares issued pursuant to the Securities Purchase Agreement would equal $10,000,000 divided by the Per Share Purchase Price, as adjusted; provided that the Per Share Purchase Price could not be reduced to less than $4.25 per Share and could not be adjusted upward. In addition, following a Triggering Event, the Exercise Price of the Warrants would automatically be reduced, if applicable, to 110% of the lowest of the three VWAPs in the VWAP Calculation; provided, that in no event would the Exercise Price for the Warrants be reduced to less than $4.25 or increased as a result of an adjustment. In the event the Exercise Price of the Warrants were adjusted, then the total number of Warrant Shares issuable upon exercise of the Warrants would be increased so that the total exercise price payable to exercise the Warrants after the adjustment is equal to the total exercise price payable to exercise the Warrants before such adjustment. As a result, the maximum number of securities that could be issued under the Securities Purchase Agreement is 2,352,940 Shares and Warrants to purchase an aggregate of 2,283,740 Warrant Shares, based on an adjusted Per Share Purchase Price of $4.25 per share and a Warrant Exercise Price of $4.25 per share.

On May 22, 2018, our Registration Statement on Form S-1 (File No. 333-225090) (the “Registration Statement”) was filed with the Securities and Exchange Commission, or SEC, to register the resale of up to 2,352,940 Shares and up to 2,283,740 Warrant Shares. On July 26, 2018, the Registration Statement was declared effective by the SEC. As a result of the effectiveness of the Registration Statement, the Warrants became exercisable on July 26, 2018, subject to ownership limitations. The Per Share Purchase Price and the Warrant Exercise Price were both adjusted to $4.25 per share, based on a VWAP of $3.5299 on July 27, 2018. On August 1, 2018, pursuant to the terms of the Securities Purchase Agreement and the Warrants, we issued to the Purchasers an aggregate of 1,174,440 additional Shares, and the Warrants became exercisable for a total of 2,283,740 Warrant Shares, with an exercise price equal to $4.25 per Warrant Share. An additional 350,000 Shares (i.e., the difference between 2,352,940 Shares and the sum of the Shares issued on May 9, 2018 and August 1, 2018) are issuable to one of the Purchasers in the Private Placement upon the request of such Purchaser under the terms of the Securities Purchase Agreement.

Until stockholder approval of the Nasdaq 20% Issuance Proposal is obtained, the total number of Shares issuable pursuant to the Securities Purchase Agreement, plus the total number of Warrant Shares issuable upon exercise of the Warrants, shall not exceed 19.99% of the number of shares of our common stock outstanding immediately before the closing of the Private Placement. The 828,500 Shares initially issued to the Purchaser under the Securities Purchase Agreement and the 1,174,440 Shares issued on August 1, 2018 following the effectiveness of the Registration Statement, together constitute 13.29% of the number of shares of our common stock that were outstanding immediately before the closing of the Private Placement.

The securities issued pursuant to the Securities Purchase Agreement were issued under the exemption from registration provided by Section 4(a)(2) of the Securities Act and the rules and regulation promulgated thereunder, including Regulation D.

Registration Rights

In connection with the Private Placement, we entered into a registration rights agreement (the “Registration Rights Agreement”) with the Purchasers. Pursuant to the Registration Rights Agreement, we agreed to prepare and file a registration statement (the “Resale Registration Statement”) with the SEC by May 21, 2018 for purposes of registering the resale by the Purchasers of up to 2,352,940 Shares and up to 2,283,740 Warrant Shares. We also agreed to use our reasonable best efforts to cause the Resale Registration Statement to be declared effective by the SEC by June 25, 2018 (or July 10, 2018 in the event of a full review by the SEC).

The Registration Rights Agreement includes provisions for liquidated damages for failure to meet the specified filing and effectiveness deadlines or keep the Resale Registration Statement effective, subject to certain

permitted exceptions. Under the Registration Rights Agreement, we have agreed to keep the Resale Registration Statement effective at all times until the earlier of (i) the date as of which the Investors may sell all of the securities covered by such registration statement without volume or manner-of-sale limitations pursuant to Rule 144 (or any successor thereto) promulgated under the Securities Act or (ii) the date on which the Investors shall have sold all of the securities covered by the Resale Registration Statement.

On May 10, 2018, we filed with the SEC a Current Report on Form 8-K (the “Form 8-K”) that described the terms of the Private Placement. We filed as exhibits 4.1, 10.1 and 10.2 to the Form 8-K the form of Warrant, the Securities Purchase Agreement and the form of Registration Rights Agreement. We refer you to the Form 8-K and the exhibits thereto for a further description of the Private Placement.

The Registration Statement was deemed filed on May 22, 2018, and was declared effective by the SEC on July 26, 2018.

Nasdaq Rule 5635(d)

Nasdaq Rule 5635(d) requires stockholder approval prior to an issuance of securities in connection with a transaction other than a public offering involving the sale, issuance or potential issuance by a company of common stock equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the greater of book and market value of our common stock as of the time of execution of the definitive agreement withWith respect to such transaction. The provisions in (i)Proposal 3, the Securities Purchase Agreement that prevent the issuance of Shares if such issuance will result in such holders beneficially owning in excess of 19.99% of our common stock (the “Beneficial Ownership Limitation”) prior to stockholder approval and (ii) the Warrants that prevent exercise of the Warrants prior to stockholder approval to the extent the issuance of Warrant Shares pursuant to such exercise, when combined with the issuances of Shares pursuant to the Securities Agreement, would be in excess of the Beneficial Ownership Limitation, are both required under Nasdaq Rule 5635(d). We are seeking stockholder approval for the sale and issuance of such Shares and Warrant Shares in connection with the Private Placement pursuant to Nasdaq Rule 5635(d) without regard to the Beneficial Ownership Limitation.

Consequences if Stockholder Approval is Not Obtained

If we do not obtain approval of the Nasdaq 20% Issuance Proposal at the Annual Meeting, we are obligated under the Securities Purchase Agreement to call a stockholder meeting every four months thereafter to seek approval of the Nasdaq 20% Issuance Proposal from our stockholders until the earlier of the date such approval is obtained or the Warrants are no longer outstanding. In addition, so long as any Warrants are outstanding, we may not issue any capital stock or equity instruments in a capital raising transaction until we obtain stockholder approval of the Nasdaq 20% Issuance Proposal. If we do not obtain stockholder approval, the maximum number of shares that will be issuable pursuant to the Private Placement will not exceed 2,605,697 shares, which equals 19.99% of the number of outstanding shares of our common stock on May 5, 2018.

Description of Proposal

We are seeking stockholder approval as required by Nasdaq Rule 5635(d) (as described above) to enable the us to issue a number of shares our common stock in connection with the Private Placement that exceeds 20% of the number of shares of our common stock that were outstanding before the Private Placement, which shares include the Shares issued pursuant to the Securities Purchase Agreement and the Warrant Shares issuable upon exercise of the Warrants, consisting of:

a total of 2,352,940 Shares issuable pursuant to the Securities Purchase Agreement; and

a total of 2,283,740 Warrant Shares issuable upon exercise of the Warrants.

Except for the sale and issuance of the Shares and the Warrants, the participants in the Private Placement have not had any material relationship with us within the past three years, other than Maxim, which served as the placement agent for the Private Placement, and Network 1 Financial Securities, Inc., which was the underwriter of our initial public offering and served as an advisor for the Private Placement. As compensation for serving as placement agent for the Private Placement, we paid to Maxim a fee of $700,000 and reimbursed Maxim’s related expenses.

Vote Required

The affirmative vote of the holders of a majority of the shares of our common stock present in person or represented by proxy and entitled to vote on the matter, excluding shares acquired in the Private Placement under the Securities Purchase Agreement,this Proposal 3 is necessary under Nasdaq Marketplace Rule 5635(e)(4)required to approve this Proposal 3. The Say-on-Pay vote on our Named Executive Officers’ compensation is advisory, and therefore not binding on the Nasdaq 20% Issuance Proposal. BrokerCompany. Proposal 3 is generally considered to be a “non-routine” matter which means that banks, brokers or other nominees do not have discretionary authority to vote on this matter. Accordingly, broker non-votes will not affect whethermay occur on this proposal is approved, but abstentionsproposal. Abstentions, if any, and broker non-votes, if any, will have the same effect asof votes against this Proposal 3.

Proposal 4: Advisory Vote on Frequency of Say-on-Pay Votes (Say-on-Frequency)

With respect to Proposal 4, the affirmative vote of a vote against the proposal.

In accordance with applicable Nasdaq Marketplace Rules, holdersmajority of the shares of our common stock purchased in the Private Placement are notpresent or represented by proxy and entitled to vote such shareson this Proposal 4 is required to approve any of the Say-on-Frequency choices presented to stockholders (“1 year”, “2 years” or “3 years”). However, the Say-on-Frequency vote is advisory, and therefore not binding on the Nasdaq 20% Issuance Proposal.

PriorCompany. Additionally, because the advisory vote entails three choices (“1 year”, “2 years” or “3 years”) in addition to stockholders’ option to abstain from voting, it is possible that none of these choices will receive the closingvote of the Private Placement, and as a condition to such closing, certain of our stockholders entered into voting agreements with the Purchasers. As of immediately prior to the closing of the Private Placement, the stockholders executing the voting agreements owned approximately 62% of our total issued and outstanding common stock. Pursuant to the voting agreements, the stockholder signatories agreed to vote all shares of our common stock owned by them in favor of the Nasdaq 20% Issuance Proposal.

Potential Effects of this Proposal

The issuancemajority of the shares of our common stock present or represented by proxy and entitled to vote on this Proposal 4. In such case, our Board of Directors expects to be guided by the option that receives the greatest number of votes, even if that option does not receive the requisite vote of stockholders to approve such option. Proposal 4 is generally considered to be a “non-routine” matter which aremeans that banks, brokers or other nominees do not have discretionary authority to vote on this matter. Abstentions, if any, and broker non-votes, if any, will have the subjecteffect of votes against this Proposal 4.

Where Can I Find the Voting Results of the Nasdaq 20% Issuance ProposalAnnual Meeting?

The preliminary voting results will result in an increase inbe announced at the number of shares of common stock outstanding. ThisAnnual Meeting, and we will resultpublish final results in a decreaseCurrent Report on Form 8-K filed with the SEC within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the respective ownership andfinal voting percentage interestsresults within four business days after the final voting results are known.

Who Will Pay the Costs of stockholders prior to the Private Placement. The market value of our Company and our future earnings may be reduced.Soliciting these Proxies?

In addition, as described above under “Registration Rights,” we have registered the securities issued in the Private Placement, which includes a total of 4,636,680 shares of our common stock, consisting of a maximum of 2,352,940 Shares issued or issuable pursuant to the Securities Purchase Agreement and 2,283,740 Warrant Shares that could become issuable upon exercise of Warrants. The release of up to 4,636,680 freely traded shares onto the market, or the perception that such shares will or could come onto the market, has had and could have an adverse effect on the trading price of our stock.

We have broad discretion to use the net proceeds to us from the sale of such shares, including the proceeds received upon exercise of the Warrants, and you will be relying solelyare soliciting this proxy on the judgmentbehalf of our Board of Directors and management regardingwill pay all expenses associated therewith. Some of our officers, directors and other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, fax or other electronic means. We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the applicationnames of these proceeds. Our usenominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of the proceeds may not improve our operating results or increase the value of your investment.

For your consideration of the Nasdaq 20% Issuance Proposal, a description of the material terms of the Private Placement is set forth in this proxy statementcapital stock and to provide you with basic information concerning the Private Placement. However, the description above is not a substitute for reviewing the full text of the referenced documents, which were attached as exhibits to our Current Report on Form 8-K as filed with the SEC on May 10, 2018.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR”

THE APPROVAL OF THE NASDAQ 20% ISSUANCE PROPOSAL.obtain proxies.

Proposals should be addressed to:

Genprex, Inc.

Attn: Corporate Secretary

3300 Bee Cave Road, #650-227

Austin, TX 78746

PROPOSAL 21

ELECTION OF CLASS IDIRECTOR

Our Board of Directors is divided into three classes.classes: Class I, Class II and Class III. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board of Directors may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board of Directors to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board of Directors presently has threefour members. There is one Class I director, David E. Friedman,Brent M. Longnecker, whose term of office expires in 2018.2024. Proxies may not be voted for a greater number of persons than the one nominee, Mr. Friedman,Longnecker, named in this proxy statement. Mr. Friedman,Longnecker, a current director of the Company, was recommended for nomination to the Board of Directors at the Annual Meeting by the Nominating and Corporate Governance Committee of the Board.Board of Directors. If elected at the Annual Meeting, Mr. FriedmanLongnecker would serve until the 20212027 annual meeting of stockholders and until his successor has been duly elected and qualified, or, if sooner, until his death, resignation or removal. It is the Company’s policy to invite directors and nominees for director to attend the Annual Meeting. Each of our directors attended our annual meeting of stockholders in June 2023.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. Accordingly, the nominee receiving the highest number of affirmative votes will be elected. The only nominee for Class I directordirectorship to be considered at the Annual Meeting is Mr. Friedman.Longnecker. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of Mr. Friedman.Longnecker. If Mr. FriedmanLongnecker becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead will be voted for the election of a substitute nominee proposed by the Company. Mr. FriedmanLongnecker has agreed to serve if elected. The Company’s management has no reason to believe that Mr. FriedmanLongnecker will be unable to serve.

NomineeNominees

The Nominating and Corporate Governance Committee seeks to assemble a Board of Directors that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct the Company’s business. To that end, the Nominating and Corporate Governance Committee has identified and evaluated nominees in the broader context of the Board’sBoard of Directors’ overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the Nominating and Corporate Governance Committee views as critical to effective functioning of the Board.Board of Directors. The biographies below include information, as of the date of this Proxy Statement,proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Nominating and Corporate Governance Committee to believe that that nominee should continue to serve on the Board.Board of Directors. However, each member of the Nominating and Corporate Governance Committee may have a variety of reasons why he believes a particular person would be an appropriate nominee for the Board of Directors, and these views may differ from the views of other members.

Nominee for Election for a Three-Year Term Expiring at the 2021 2027Annual Meeting

David E. FriedmanBrent M. Longnecker, 55,67, has served as a member of our Board since March 18, 2020. Since January 2021, Mr. Longnecker has been the Chairman and Chief Executive Officer of 1 Reputation, a strategy, executive compensation, and corporate governance consulting firm. From August 2012. Since2003 to February 2022, Mr. Longnecker was Founder & CEO of Longnecker & Associates. From June 1999 to August 2010,2003, Mr. Friedman hasLongnecker served as aPresident of Resources Consulting Group, and Executive Vice President of Resources Connection. Mr. Longnecker has over 36 years of consulting experience, including as National Partner-In-Charge for the Performance Management and Compensation Consulting Practice of Deloitte & Touche and as partner at KPMG Peat Marwick. Mr. Longnecker has worked with companies globally including the industries of TCG Group Holdings, an Austin, Texas based SEC-registered investment advisor to separately-managed institutionalhigh tech, finance, service, manufacturing and private client accounts. In addition, since January 2012, Mr. Friedman has served as a managing partner of ACM Investment Management, which manages hedge fund assets acquired from KeyCorp, the bank holding company parent of KeyBank. From 2006 to 2010, Mr. Friedman served as the Chief Operating Officer of Austin Capital Management, which was owned by KeyCorp, where he led the company’s non-investment functions, including all legal, finance, investor relations, technology and operations teams. Before joining Austin Capital, Mr. Friedman was a Director on the Global Prime Brokerage desk of Citigroup in New York, and an associate at the law firm of Proskauer Rose in its New York headquarters. Mr. Friedman received his BS in management from Tulane University and his JD from Duke University School of Law.more. He is admitted toa Board Fellow with the BarNACD and is a past board member. Mr. Longnecker holds Bachelor of Business Administration and MBA degrees from the StateUniversity of New YorkHouston. He is a prolific author about executive compensation and holds FINRA Series 4, 7, 24 and 63 securities registrations.corporate governance.

Our Nominating and Corporate Governance Committee and Board of Directors believe that Mr. Friedman’s uniqueLongnecker’s more than 36 years of experience in corporate governance, executive compensation, and valuable mix of high-levelrisk management consulting for public, private, and relevant finance, legalnon-profit organizations, and operations experiencehis deep expertise in healthcare, energy, real estate, manufacturing, and financial companies, makes him a well-rounded business leader and a valuable member of our Board.Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS

THAT STOCKHOLDERS VOTE “FOR”“FOR” THE ELECTION OF MR. FRIEDMAN

BRENT M. LONGNECKER AS THE CLASS IDIRECTOR.

Class II Director Continuing in Office Until the 20192025 Annual Meeting

Robert W. PearsonWilliam (“Will”) R.Wilson, Jr., 56,74, has served as a member of our Board of Directors since July 2012. In June 2009,March 18, 2020. Since January 2006, he has served as Chairman, President and Chief Executive Officer of Wilson Land & Cattle Co., an investment company. Mr. Pearson joined W2O Group,Wilson has more than 40 years of legal experience in health care regulation, biotechnology, clinical trial management, nursing home licensing and regulation, physician accreditation, securities, corporate governance, contractual and other legal matters. Mr. Wilson is a global networkmember of complementary marketing, communications, research and development firms,the State Bar of Texas and has held a numberbeen admitted to practice before the United States District Court for the Western District of senior positions at W2O Group, including Chief Technology Officer, President and since February 2017, Vice Chair and Chief Innovation Officer. From March 2012 to February 2017,Texas. Mr. Pearson served as President of W2O, and from June 2009 to March 2012 as its Chief Technology & Media Officer. From 2007 to 2009, Mr. Pearson served as Dell Inc.’s Vice President, Communities and Conversations, and before that as its Vice President, Corporate Group Communications. From 2003 to 2006, Mr. Pearson served as Head of Global Corporate Communications and as Head of Global Pharma Communications at Novartis Pharmaceuticals, where he also served on the Pharma Executive Committee. Before joining Novartis, Mr. Pearson served as President, The Americas and Chair, Healthcare Practice for GCI Group, a global public relations consultancy, and was responsible for creating and building the firm’s global healthcare practice. Mr. PearsonWilson previously served as Vice PresidentJudge of Mediathe 250th District Court of Travis County, Texas, where he presided over civil litigation, and Public Affairs at Rhone-Poulenc Rorer, or RPR (now Sanofi-Aventis) and worked at RPR and Ciba-Geigy in communications and pharmaceutical field sales.as Assistant District Attorney for Dallas County, Texas. Mr. PearsonWilson holds a BABachelor of Arts degree from theVanderbilt University of North Carolina at Greensboro and an MBAa JD degree from Fairleigh DickinsonSouthern Methodist University.

Our Nominating and Corporate Governance Committee and Board of Directors believe that Mr. Pearson’s senior managementWilson’s more than 40 years of experience at international pharmaceutical companiesas an attorney in fields related to our business, and public relations/as an investor, relations firms, as well as with start-up businesses, and his knowledge and personal contacts in the pharmaceutical industry, and his business management acumen, makemakes him a valuable member of our Board.Board of Directors.

DirectorClass III Directors Continuing in Office Until the 20202026 Annual Meeting

Jose Antonio Moreno Toscano, 51, has served as a member of our Board of Directors since March 18, 2020. Since April 2018, Mr. Moreno Toscano has been Chief Executive Officer of LFB USA Inc., the US subsidiary of LFB Group, a global integrated biopharmaceutical company dedicated to developing innovative products through recombinant, plasma derived and cell therapy technology. From July 2017 to March 2018, Mr. Moreno Toscano served as President of Safe Harbor Compliance and Clinical Services, an integrated health care services provider dedicated to providing specialty pharmaceuticals and ancillary services in primary care offices. From July 2016 to September 2018, he also served as a member of the board of directors. From March 2016 to March 2017, Mr. Moreno Toscano served as CEO, Americas, for Kompan Inc., a US subsidiary of Kompan A/S, a world leader in playground equipment. From March 2006 to March 2016, Mr. Moreno Toscano served as President of ALK-Abello Inc., a US subsidiary of ALK-Abello A/S, a pharmaceutical company that is a world leader in allergy immunotherapy. Prior to ALK-Abello, he was the Chief Financial Officer of Applus A/S, a market leader in automotive inspection services, and prior to Applus, he held several positions at Christian Hansen Holding A/S, a global leader in pharmaceutical manufacturing and producer of natural ingredients for the food, beverage, dietary supplement and agricultural industries. Mr. Moreno Toscano holds a Master’s Degree in Law from the Universidad de Murcia in Spain and an MBA in International Finance and Strategy from the Ecole Nationale des Ponts et Chaussees in Paris. Mr. Moreno Toscano holds the National Association of Corporate Directors (NACD) Directorship CertificationTM.